5 Top Stocks to Watch in 2025

Tech and AI stocks are dominating the market right now. If we look at the top 10 best performing stocks in the S&P 500 Index now, we’ll see 9 of 10 top stocks are related to AI.

We have the common suspects up there like Nvidia and Alphabet. But the best performing stock in the S&P 500 right now is a company called Vistra (VST). This company was previously a boring business few had heard of. It’s in the power generation business. It generates power and sells it to companies or utilities that need it.

But with companies spending hundreds of billions of dollars a year on expanding data center capacity for AI applications, power is quickly becoming a scarce commodity.

Don’t let these gains fool you though. Tech and AI stocks are compelling buys right now. The winners in the AI race will have unmatched potential for rapid growth. And this transformative impact crosses all sectors.

We’re witnessing an accelerated shift toward a digital-first world, where companies across industries—from healthcare to finance to manufacturing—are adopting AI to drive efficiency, enhance decision-making, and deliver new products and services.

As these technologies scale, the companies leading AI innovation are positioned to capture massive market share and disrupt traditional business models, which could translate into unprecedented revenue and profit growth over the next decade.

For investors, this represents a rare opportunity to buy into a sector with substantial runway for growth, fueled by steady technological advancements and global adoption.

Let’s take a look at some of our favorite companies on our 2025 watchlist.

- Palantir Technologies (NASDAQ: PLTR)

Palantir is one of the most intriguing plays in data analytics and artificial intelligence. Palantir specializes in transforming vast data sets into actionable intelligence for large organizations and government agencies. With its flagship platforms, Gotham and Foundry, Palantir offers solutions that touch every critical sector – defense, cybersecurity, healthcare, and financial services. This versatility allows Palantir to serve both government and commercial clients, giving it a diversified revenue stream that’s resilient to economic fluctuations.

Palantir’s deep ties with the U.S. government, particularly the Department of Defense, give it a credibility and stability that few tech companies can rival. These relationships, built over years of proven performance give Palantir a strong revenue anchor.

But the story doesn’t stop there. Palantir has made aggressive inroads into the commercial sector. This expansion is unlocking a new, lucrative revenue stream for the company. This blend of government and private-sector contracts sets Palantir apart.

And let’s talk about Palantir’s recent developments in artificial intelligence. The company is heavily investing in AI-driven software solutions that enable clients to use data with precision. Demand for real-time, AI-based insights is becoming a must-have for many businesses. One example of how this is used is in a retail setting. A retailer can use Palantir’s tools to analyze real-time sale and customer behavior. This allows them to adjust marketing campaigns and inventory in response to demand surges. It was also used to track the spread of COVID-19 and by financial services to detect fraud.

Palantir’s tools are becoming indispensable. Its platforms integrate into client operations, making their complex data actionable – this is the kind of insights that only AI can give.

Financially, Palantir is in a far stronger position than it was just a few years ago. The company has turned profitable and is now focusing on sustainable growth. With an emphasis on cost discipline and operational efficiency, Palantir has improved its margins and demonstrated it can balance growth with profitability. Moreover, its strategy of securing high-value, long-term contracts gives it a predictable revenue base and substantial growth runway.

Investors looking for exposure to the future of AI-driven analytics will find Palantir compelling in the current market.

- Microsoft (NASDAQ: MSFT)

Microsoft has built a dominant position in multiple high-growth sectors like cloud computing, artificial intelligence, and enterprise software. Microsoft’s Azure service as made it a leader in cloud services. They continue to expand its revenue by providing scalable, secure, and reliable cloud solutions to enterprises worldwide. With businesses increasingly reliant on cloud infrastructure, Azure’s rapid growth will drive sustained revenue gains for Microsoft in the years to come.

Beyond cloud computing, Microsoft has made significant strides in artificial intelligence. Through its strategic partnership with OpenAI, Microsoft is integrating AI capabilities across its product ecosystem. From Microsoft 365 and Azure to Dynamics 365, AI is enhancing productivity, streamlining operations, and embedding intelligence into everyday workflows for millions of clients. This seamless integration of AI strengthens the value of Microsoft’s software and cloud offerings, making them indispensable to businesses globally.

Financially, Microsoft has a robust balance sheet, strong free cash flow, and a history of consistent dividend payouts. These are all qualities that offer stability and appeal to long-term investors. Its diversified revenue base across in-demand tech segments, makes it resilient against market fluctuations.

- Tesla (NASDAQ: TSLA)

Tesla is more than an electric vehicle company—it’s also a pioneer in artificial intelligence and energy storage. With a growing ecosystem that spans self-driving cars, advanced AI, and renewable energy solutions like solar power and battery storage, Tesla has positioned itself as a technology powerhouse. Tesla’s Full Self-Driving (FSD) technology alone could disrupt the $1.5 trillion global transportation market as autonomous driving becomes mainstream, putting the company at the forefront of a transformative shift in how we get around.

Tesla’s vertical integration is a competitive advantage that sets it apart. By producing its own batteries, chips, and parts for its vehicles, Tesla can achieve cost efficiencies and quality control that traditional automakers can’t match. And they are opening Gigafactories worldwide. This has them ready to enter new markets. Tesla is primed for continued growth as global demand for EVs and sustainable energy solutions accelerates.

Financially, Tesla’s track record is impressive. They have shown consistent revenue growth and margin improvements that showcase its ability to scale. CEO Elon Musk’s ambitious vision for the company is consistently backed by achievements. This reinforces Tesla’s position as a leader with an exceptionally loyal customer base and strong brand recognition. For investors, Tesla represents not just a bet on EVs but a stake in several high-growth sectors. This is a company primed to lead the way in the future of transportation, AI, and sustainable energy solutions.

- SoFi Technologies (NASDAQ: SOFI)

SoFi is rewriting the rules of personal banking with a highly innovative, digital-first approach. SoFi is capturing the loyalty of young, tech-savvy consumers by offering a comprehensive suite of financial services—including loans, investments, banking, and insurance—on one seamless platform. With digital banking gaining traction, SoFi is positioned to secure significant market share as more consumers gravitate towards modern, convenient alternatives to traditional banks.

A major turning point for SoFi was its recent acquisition of a bank charter. This move not only enables SoFi to offer more competitive interest rates but also reduces its reliance on third-party banks. This increases profitability and gives it more control over its products. With a full suite of services now under a unified brand, SoFi is solidifying its place as a one-stop solution for a generation seeking digital finance options.

SoFi’s growth strategy is multi-dimensional, covering student loan refinancing, personal loans, and mortgages. Each segment adds a diversified revenue stream, reducing overall risk and creating pathways to capture consumers at different life stages. SoFi’s approach has built a highly engaged community, resulting in consistent revenue from repeat customers and a brand loyalty that traditional banks often struggle to match. Investors looking to gain exposure to the future of digital finance can capitalize on SoFi's expanding market reach. We believe the stock presents strong long-term potential.

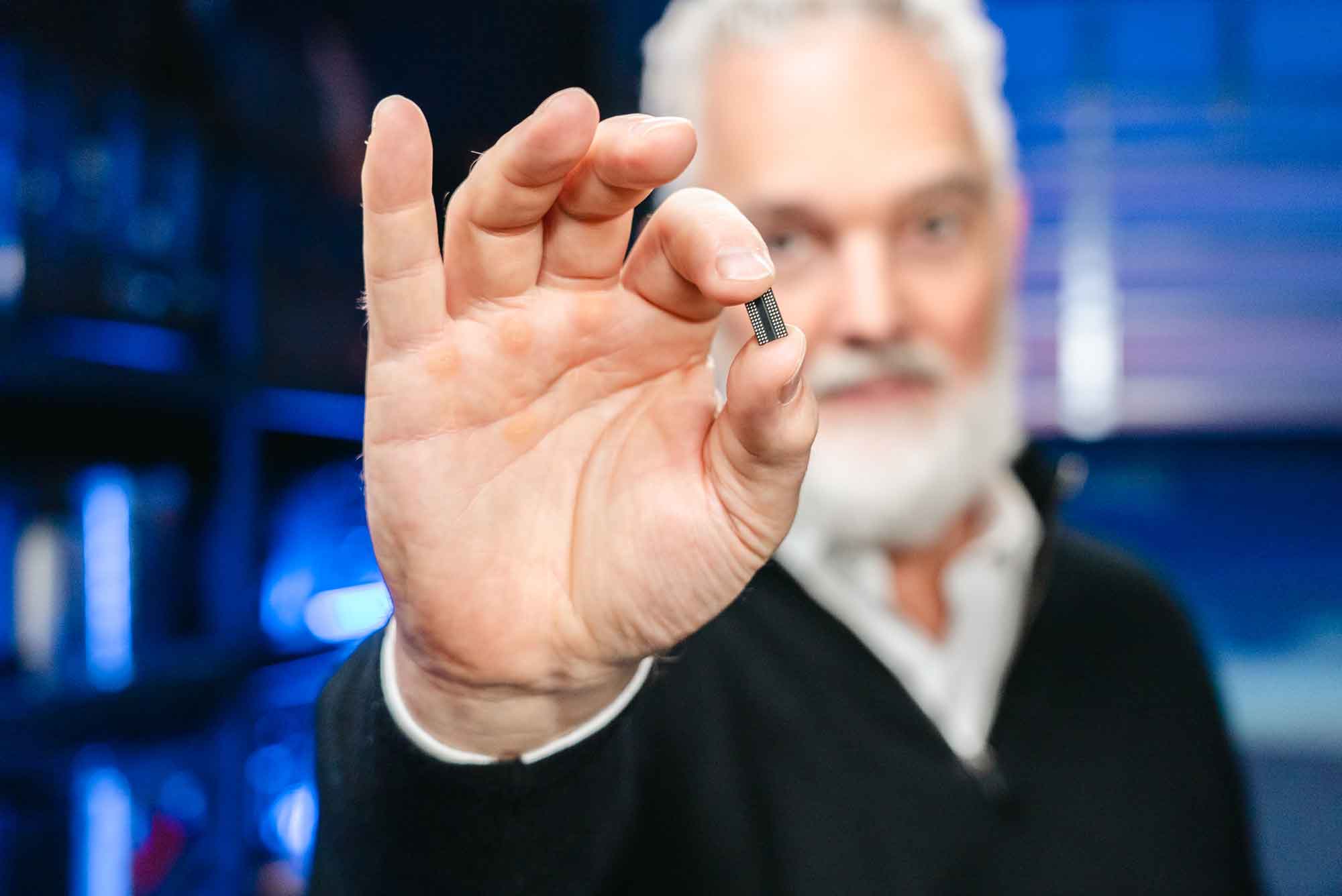

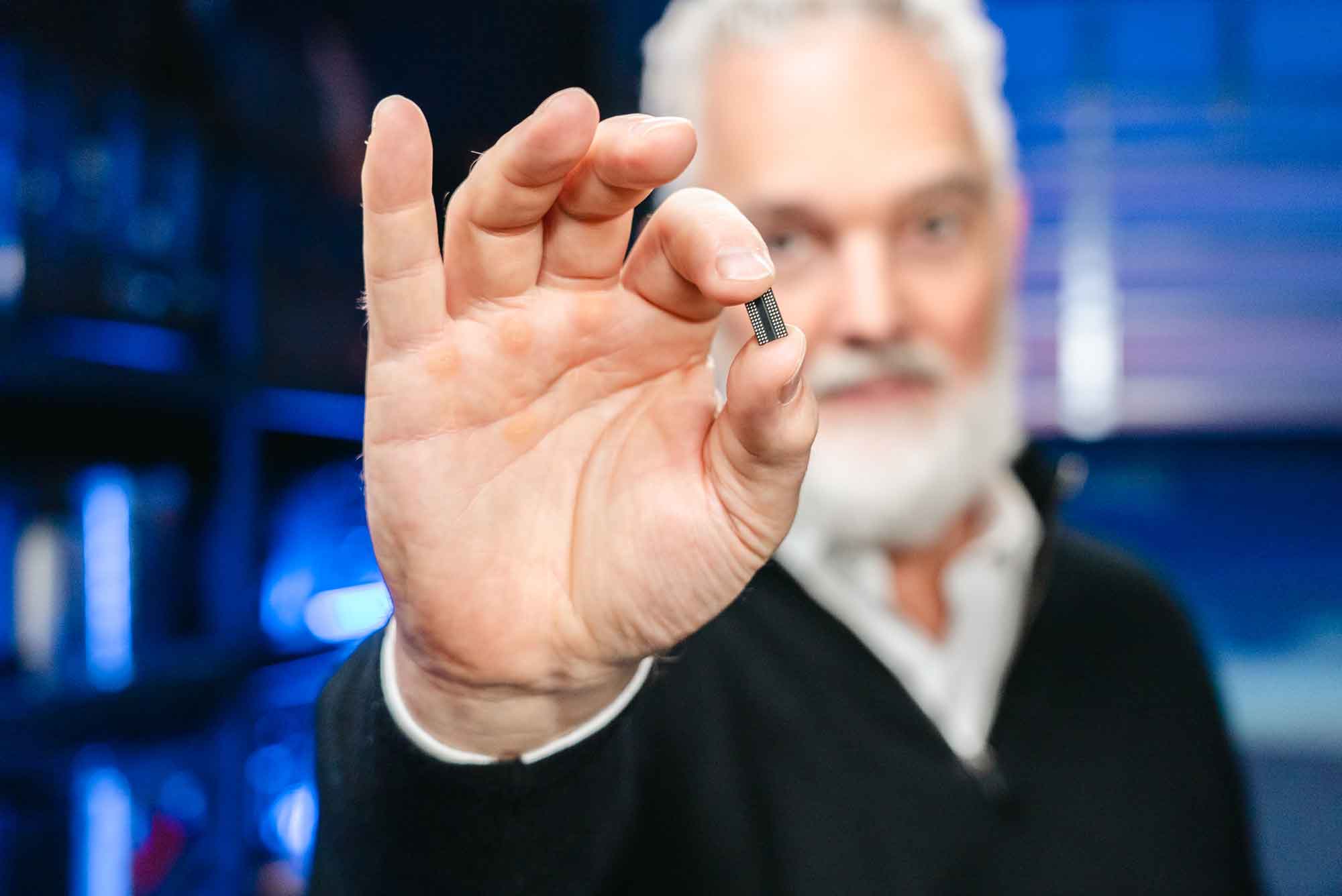

- Our Favorite Pick: Strange Device Behind Elon Musk’s New $9 Trillion Venture

Take a look at this strange, tiny device…

It’s smaller than a quarter…

But I believe it’s going to power Elon Musk’s next AI revolution…

A revolution he believes will be worth more than $9 trillion.

That’s nearly 10 times more money than the market caps of Tesla… SpaceX… PayPal… Neuralink… and X… COMBINED.

Click here to see the details because I believe a lot of people will get rich.

Believe it or not…

Musk says this device could even help put an extra $30k in your pocket every year… simply by using this technology.